kansas auto sales tax calculator

Vehicle property tax is due annually. Kansas Vehicle Property Tax Check - Estimates Only.

In addition to taxes car purchases in Kansas may be subject to other fees like registration title and plate fees.

. All you need is your dealerships address or zip code to get a close estimation. First Letter of Last Name. The average cumulative sales tax rate in the state of Kansas is 806.

The sales tax in Sedgwick County is 75 percent InterestPayment Calculator Price of Car Sales Tax Rate Down Payment Loan Term years Interest Rate Total Price. The average cumulative sales tax rate between all of them is 663. To see the list of sales tax in each county or city please refer to the table given at the bottom of this page.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. The average cumulative sales tax rate in Mcpherson Kansas is 9. This takes into account the rates on the state level county level city level and special level.

How to File and Pay Sales Tax in Kansas. If you make 70000 a year living in the region of Kansas USA you will be taxed 12078. Both long- and short-term gains are subject to the income tax rates listed above with a top rate of 570 for 2021.

Please note that special sales tax laws max exist for the sale of cars and vehicles services or other types of transaction. Anytime you are shopping around for a new vehicle and are beginning to make a budget its important to factor in state taxes titling and registration fees vehicle inspectionsmog test costs and car insurance into your total cost. Kansas Capital Gains Tax.

How to Calculate Kansas Sales Tax on a Car To calculate the sales tax on your vehicle find the total sales tax fee for the city andor county. Knowing how much sales tax you owe. Use the Kansas Department of Revenue Vehicle Property Tax Calculator to estimate vehicle property tax by makemodelyear VIN or RV weightyear for a partial or full registration year.

The sales tax rate for Shawnee was updated for the 2020 tax year this is the current sales tax rate we are using in the Shawnee Kansas Sales Tax Comparison Calculator for 202223. The most populous zip code in Butler County Kansas is. Free calculator to find the sales tax amountrate before tax price and after-tax price.

Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. This includes the rates on the state county city and special levels. There are also local taxes up to 1 which will.

Kansas Income Tax Calculator 2021. The most populous location in Butler County Kansas is El Dorado. Filing a sales tax return.

If this rate has been updated locally please contact us and we will update the sales tax rate for Shawnee Kansas. Kansas collects a 73 to 8775 state sales tax rate on the purchase of all vehicles. Vehicle Property Tax Calculator Estimate vehicle property tax by makemodelyear or VIN Vehicle Tags and Titling What you need to know about titling and tagging your vehicle.

Please note that special sales tax laws max exist for the sale of cars and vehicles services or other types of transaction. You can find these fees further down on the page. Key Takeaway Combined state and local sales tax on a car purchase in Kansas ranges from 75 to 115 depending on your location.

How much does it cost to register a vehicle. The minimum is 65. Your average tax rate is 1198 and your marginal tax rate is 22.

The average cumulative sales tax rate between all of them is 663. Capital gains in Kansas are taxed as regular income. Insofar filing and paying sales tax in Kansas is considered three things need to be kept in mind while you do this.

You can use an online calculator from the Kansas Department of Revenue to estimate your total car sales tax based on your location. There are also local taxes up to 1 which will vary depending on region. You pay property tax when you initially title and register a vehicle and each year when you renew your vehicle tags and registration.

You will pay property tax when you initially register a vehicle and each year when you renew your vehicle registration. Likewise taxpayers with a federal adjusted gross income AGI of less than 30615 may claim the Food Sales Tax Credit. The most populous county in Kansas is Johnson County.

Kansas auto sales tax calculator. Search for Vehicles by VIN -Or- Make Model Year -Or- RV Empty Weight Year. For example imagine you are purchasing a vehicle for 45000 with the state sales tax of 65.

As far as all counties go the place with the highest sales tax rate is Johnson County and the place with the lowest sales. Mcpherson is located within McPherson County KansasWithin Mcpherson there is 1 zip code with the most populous zip code being 67460The sales tax rate does not vary based on zip code. Multiply the vehicle price after trade-ins andor incentives by the sales tax fee.

This calculator can help you estimate the taxes required when purchasing a new or used vehicle. Download or Email IRS 4972 More Fillable Forms Register and Subscribe Now. Vehicle Property Tax Estimator Use this online tool from the Kansas Department of Revenue to help calculate the amount of property tax you will owe on your vehicle.

Purchase Amount Purchase Location ZIP Code -or- Specify Sales Tax Rate. As far as all cities towns and locations go the place with the highest sales tax rate is Andover and the place with the lowest sales tax rate is Augusta. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Kansas local counties cities and special taxation districts.

You can use our Kansas Sales Tax Calculator to look up sales tax rates in Kansas by address zip code. Sales tax in Shawnee Kansas is currently 96. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Kansas local counties cities and special taxation districts.

Dmv Fees By State Usa Manual Car Registration Calculator

2021 Capital Gains Tax Rates By State

Trade In Sales Tax Savings Calculator Find The Best Car Price

Car Tax By State Usa Manual Car Sales Tax Calculator

Missouri Car Sales Tax Calculator

Property Tax How To Calculate Local Considerations

Should You Move To A State With No Income Tax Forbes Advisor

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

Calculateme Com Calculate Just About Everything Area Of A Circle Gas Mileage Calculator

How To Set Tax Percentage On Calculator Easy Way Youtube

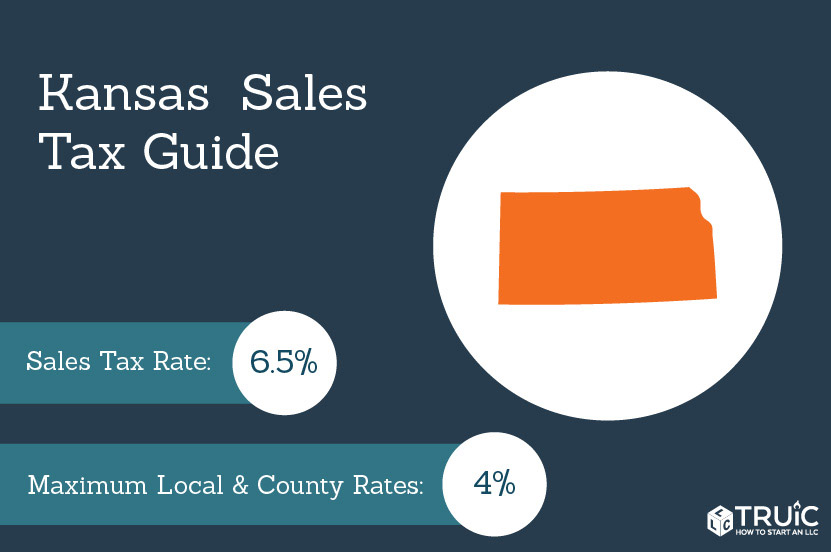

Kansas Sales Tax Small Business Guide Truic

How To Calculate Sales Tax On Calculator Easy Way Youtube

Kansas Vehicle Sales Tax Fees Find The Best Car Price

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

Colorado Vehicle Sales Tax Fees Calculator Find The Best Car Price

Car Tax By State Usa Manual Car Sales Tax Calculator

How To Calculate Sales Tax How To Find Out How Much Sales Tax Sales Tax Calculation Youtube