what items are exempt from sales tax in tennessee

If a taxpayer purchases taxable goods or services in. Groceries is subject to special sales tax rates under Tennessee law.

Ms Cheap Tennessee S Tax Holiday 2022 Offers Savings On Groceries For All Of August Ms Cheap Mainstreet Nashville Com

Tennessee does not exempt any types of purchase from the state sales tax.

. In the state of Tennessee sales tax is legally required to be collected from all tangible physical products being sold to a consumer. Information for farmers timber harvesters nursery operators and dealers from whom they buy to understand the scope of. 12 - Tennessee Sales Tax Exemptions.

Tennessee By Eduardo Peters August 15 2022 August 15 2022 Clerical vestments golf clothing galoshes diapers swimsuits lingerie and underwear pajamas hats. Tennessee does not exempt any types of purchase from the state sales tax. The latest ones are on Sep 21 2022.

Some goods are exempt from sales tax under Tennessee. Nonprofit organizations that meet the requirements set forth in WV Code 11-15-9f general nonprofit organization exemption may claim the exemption from sales or use tax on their. Several examples of of items that exempt from Tennessee.

STH-11 - Textbooks are Exempt from Sales and Use Tax. Up to 4 cash back The Walmart Tax-Exemption Program WTEP is our tool to allow an exempt customer to be recognized for automatic removal of taxes during checkout of. All individuals as well as businesses operating in the state must pay use tax when the sales tax was not collected by the seller on otherwise taxable products brought or shipped into.

A textbook is defined. By Eduardo Peters August 15 2022 August 15 2022. Tax imposed on non-exempt items and taxable services that were not taxed at the point of sale.

Groceries is subject to special sales tax rates under Tennessee law. Tennessee Department of Revenue Taxes Sales Tax Holiday Follow STH-2 - Sales Tax Holiday - Qualifying Items During the holiday the following items are exempt from sales. What Items Are Exempt From Sales Tax In Tennessee.

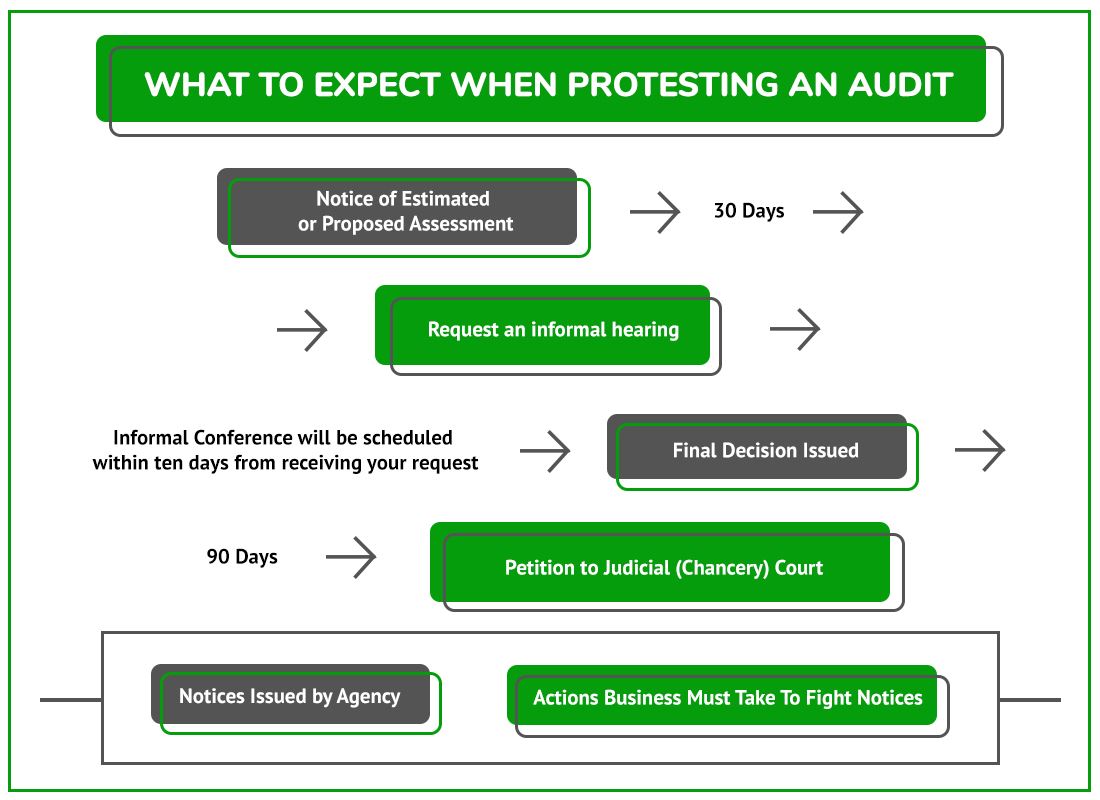

Sales and Use Tax Guide - Tennessee. 355 new Tennessee Sales Tax Exempt Items results have been found in the last 51 days which means that every 1275 new information is figured out. Therefore no holiday is necessary.

Textbooks and workbooks are exempt from sales tax. In most states necessities such as groceries. Exemptions Certificates and Credits Agricultural Exemption.

If you are looking for the latest and most special shopping information for Tennessee Sales Tax Exempt Items results we will bring you the latest promotions along with gift information and.

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Three Sales Tax Holidays Coming Soon In Tennessee

Tennessee To Have Three Sales Tax Holidays In 2022 Ucbj Upper Cumberland Business Journal

Historical Tennessee Tax Policy Information Ballotpedia

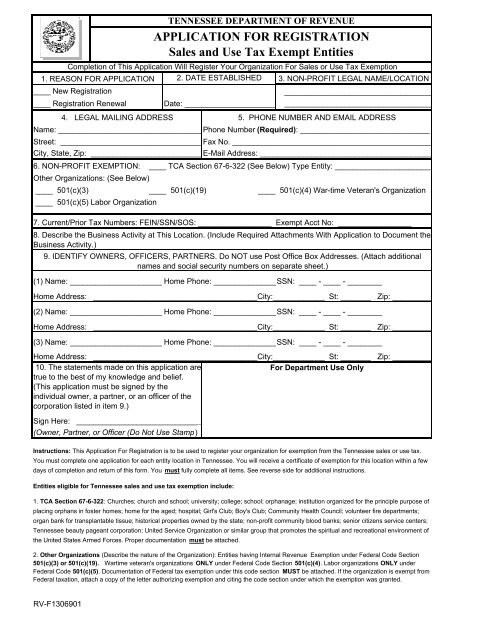

Tennessee Non Profit Sales Tax Exemption Certificate

Tn Sales Tax Holiday This Weekend Another For Groceries In August Local News Local3news Com

Tennessee Bill Would Exempt Groceries From Sales Tax For May Through October 2021 Wbir Com

Tennessee Sales Tax Holiday What You Need To Know

Tennessee Groceries Will Be Tax Free For The Entire Month Of August Check Here For A List Of Included Items Thunder Radio

Volunteer State Ends Tax On Coins Currency And Bullion

Tennessee 2022 Sales Tax Calculator Rate Lookup Tool Avalara

Tennessee Sales Tax Exemption For Manufacturers Agile Consulting

Application For Industrial Machinery In Tennessee Fill Out Sign Online Dochub

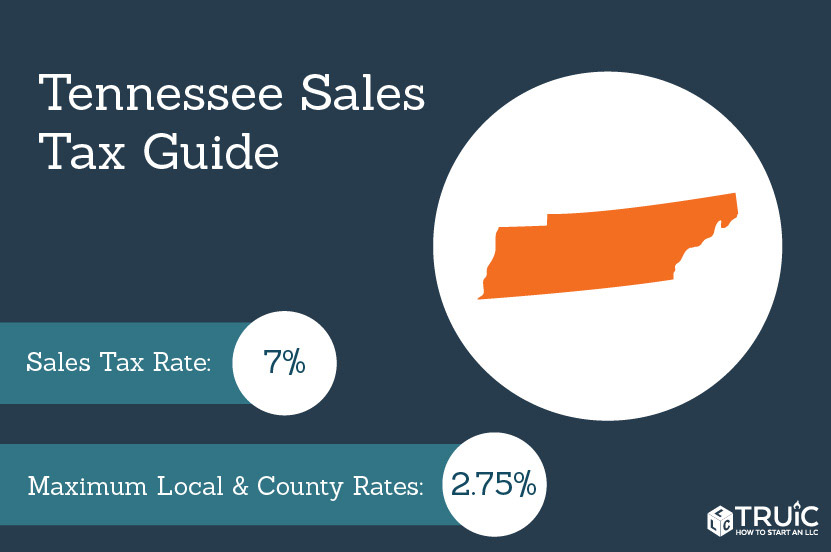

Tennessee Sales Tax Small Business Guide Truic

3 Sales Tax Holidays In Tennessee Wreg Com

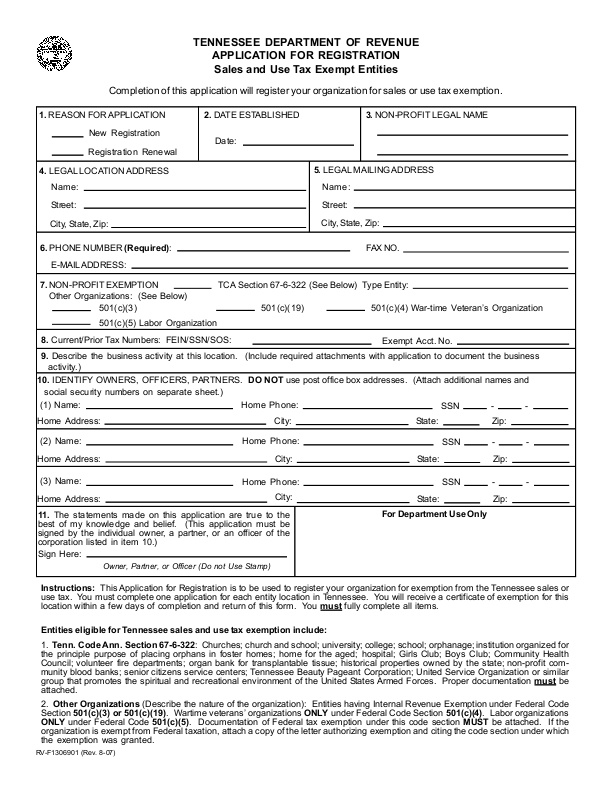

Tennessee Department Of Revenue Application For Registration Sales And Use Tax Exempt Entities Icma Org

Your Guide To Tennessee S Tax Free Weekend 2022

Get Ready To Save Three Sales Tax Holidays In 2022 Smith County Insider